Overview

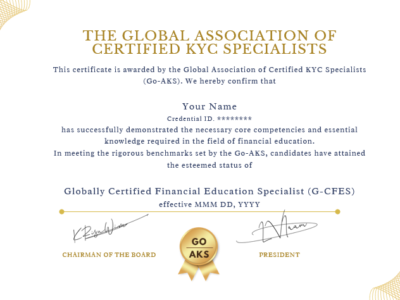

About the GO-AKS KYC Certification

The GO-AKS – Globally Certified KYC Specialist is an industry-trusted and globally recognized KYC certification, widely regarded as the gold standard in KYC worldwide. Built for modern compliance roles, the program delivers practical mastery of Corporate and Individual KYC, CDD/EDD, onboarding workflows, sanctions, PEP, and adverse media screening, and financial crime prevention across global financial institutions.

Recognition & Accreditation

-

ONRIGA Gold-tier Accredited — validating curriculum quality, governance, and assessment rigor.

-

Recognized by the American CBM Association — enhancing employer confidence and credibility.

-

A Global AKS–issued education credential is officially listed in FINRA’s U.S. & Canadian Professional Designations Database, reinforcing trust, transparency, and regulatory alignment.

Why Professionals Choose GO-AKS

-

Global recognition across 180+ countries by financial institutions, fintechs, KYC centers, and compliance teams.

-

Practice-based curriculum designed from real KYC workflows used in leading global banks.

-

Comprehensive coverage, including:

-

Corporate & Individual KYC

-

UBO identification & ownership structures

-

CDD & EDD methodologies

-

Sanctions, PEP, and adverse media screening

-

Source of Funds / Source of Wealth review

-

High-risk entity and jurisdiction assessment

-

FATF, Basel, EU AML, OFAC, FinCEN, Wolfsberg frameworks

-

End-to-end KYC lifecycle & ongoing due diligence

-

Enrolment Overview

1. Payment & Course Access

After clicking Add to Cart and completing payment (all-inclusive fee), candidates receive instant access to:

-

Downloadable Study E-Booklet covering the full GO-AKS syllabus

-

2 Mock Exam Attempts

-

2 Final Exam Attempts (lifetime validity — take the exam anytime)

Upon passing, the digital certificate is issued instantly along with a unique credential ID.

2. Exam Format & Scoring

-

Format: MCQs, 100% online

-

Passing Score: 85%

-

Scoring:

-

Correct: +1

-

Incorrect: 0

-

Skipped: –1

-

Retakes

-

Two attempts included

-

Additional attempts available for $19 USD

-

Request via support@globalaks.com

Renewal Policy

The certification is valid for 2 years.

Renewal is required every 2 years at 25% of the original fee.

Curriculum updates are added regularly based on input from global KYC teams and investment banks.

Download the Official GO-AKS Certification Guide & Syllabus

A detailed GO-AKS Enrolment Guide & Official Syllabus (PDF) is available in the curriculum section.

It includes:

-

Full syllabus breakdown

-

Accreditation details

-

Exam format & scoring

-

Career relevance

-

Renewal policy

-

Global industry alignment

Download the guide here: Click Here to download

Certificate Verification

Employers can verify any GO-AKS credential instantly using the official verification portal: Verify Certificate

Course Features

- Lectures 3

- Quizzes 2

- Duration Lifetime access

- Skill level Expert

- Language English

- Students 25567

- Assessments Self

Curriculum

- 5 Sections

- 3 Lessons

- Lifetime

- GO-AKS Certification Guide & Official Syllabus (FREE)1

- Go-AKS KYC Certification : Study Material1

- Globally Certified KYC Specialist (Go-AKS) : Mock Exam1

- Globally Certified KYC Specialist (Go-AKS) : Final Assessment1

- Certification Access1

Reviews

FAQs

Requirements

- There are no prerequisites for this course.

- Desktop, Laptop or Mobile with Internet connection.

Target audiences

- Graduate students studying finance, business administration, or law who wants to pursue career in compliance

- KYC professionals seeking to enhance their knowledge of KYC principles and practices to improve their employability in the compliance industry.