Overview

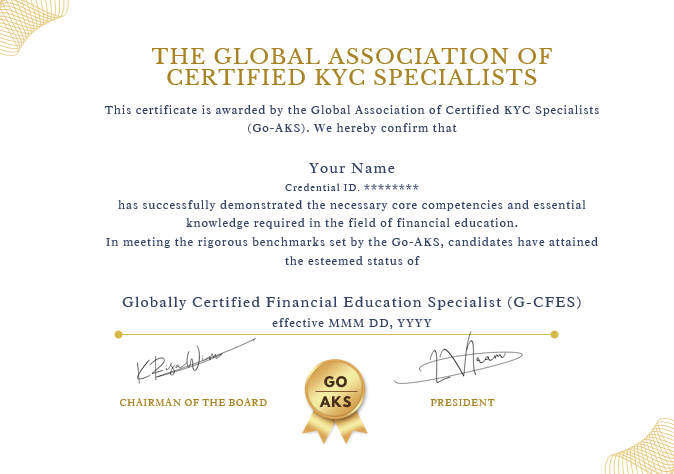

Globally Certified Financial Education Specialist (G-CFES) certification is awarded by the Global Association of Certified KYC Specialists (Go-AKS), a globally recognized association acknowledged in over 180 countries.

Globally Certified Financial Education Specialist (G-CFES) Enrolment Procedure and Curriculum

Enrolment and Access Procedure:

- Payment and Course Access:

- Click on the add to cart option to pay the fees (listed fees covers everything including tax). Upon payment, candidates gain access to the course materials, mock exam and 2 attempts for final exam.

- This membership includes the ability to download the study e-booklet that covers the full syllabus along with mock exams and final exam.

- Study Materials:

- The e-booklet provided contains comprehensive information on all topics required for the G-CFES exam.

- Mock Exams:

- Students will receive access to a mock exam attempts to practice and prepare for the final exam.

- Final Exam Details:

- After studying and completing mock exam, students can attempt the final exam at any time (Lifetime access)

- The final exam consists of multiple-choice questions (MCQs) and can be taken online at any time convenient to the student.

- Once exam is passed, candidate will get certificate along with credential ID on an email(The request can be prioritized if needed)

- Scoring and Retakes:

- A passing score of 75% is required.

- There are no negative marks for incorrect answers. However, skipping questions will result in negative marks.

- If all initial attempts are exhausted, each subsequent exam attempt will incur a fee of $19 USD.

Globally Certified Financial Education Specialist (G-CFES) Curriculum

Module 1: Introduction to Financial Education

- Understanding Financial Literacy

- The Role of Financial Education in Personal Finance

- Financial Well-Being and its Importance for Retail Clients

- Legal Framework for Financial Education

Module 2: Fundamentals of Personal Finance

- Budgeting and Saving Strategies

- Managing Debt and Credit

- Retirement Planning Basics

- Investment Principles for Retail Investors

Module 3: Educating on Investment Strategies

- Principles of Long-Term Investment

- Risk and Return in Investment Planning

- Understanding Different Asset Classes (Stocks, Bonds, Mutual Funds)

- Educating on Retirement Accounts (401k, IRAs, etc.)

Module 4: Financial Wellness Programs

- Designing and Delivering Financial Wellness Programs

- Financial Wellness for Employees and Individuals

- Assessing Financial Health and Literacy Levels

- Strategies for Enhancing Financial Wellness in Retail Clients

Module 5: Financial Advisor Training Techniques

- Methods for Training Financial Advisors in Retail Banking

- Building Confidence in Providing Financial Advice

- Client Communication and Engagement Techniques

- Ethical Considerations in Financial Advising

You will have lifetime access to the materials, and we will continuously update them with new topics based on feedback from various investment banks to ensure you stay current with industry standards.

Course Features

- Lecture 1

- Quizzes 2

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 8286

- Assessments Yes

Curriculum

Curriculum

- 3 Sections

- 1 Lesson

- Lifetime

- G-CFES Certification : Study Material1

- G-CFES: Mock Exam1

- G-CFES: Final Exam1

Reviews

Features

- G-CAFA’s global recognition opens up career opportunities in international markets, allowing you to work with multinational organizations and global financial institutions.

- The G-CAFA certification is widely recognized in the industry, boosting your professional reputation and making you a more attractive candidate for senior roles in compliance, risk management, and financial crime prevention.

- G-CAFA equips you with advanced skills in KYC, AML, and financial fraud detection, which are increasingly sought after by employers in the financial services sector.

- With the specialized expertise gained through G-CAFA, you can position yourself for higher-paying roles, including positions such as Senior Compliance Officer, AML Director, and Fraud Risk Manager.

Target audiences

- AML professionals who focus on detecting and preventing money laundering and terrorist financing activities, looking to enhance their skills in identifying complex fraud schemes.

- Risk managers and analysts focused on identifying and mitigating financial fraud risks within their organizations

- Individuals involved in the KYC process who need to identify and mitigate potential risks of fraud and financial crime in customer onboarding and ongoing monitoring.