Overview

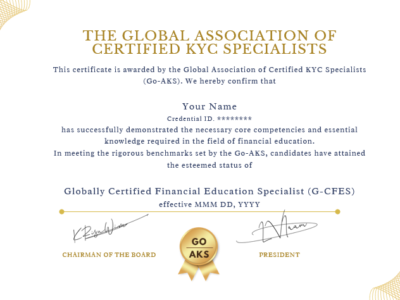

The GO-AKS KYC Certification is a globally recognized KYC certification and the gold standard in KYC worldwide. Awarded by the Global Association of Certified KYC Specialists (Go-AKS) and recognized in over 180 countries, this certification equips compliance officers, risk analysts, and financial professionals with expertise in KYC regulations, customer due diligence (CDD), enhanced due diligence (EDD), and AML best practices. Ideal for those looking to advance their careers and stay ahead in the evolving compliance landscape.

Version: 2.2 (06-May-2024): We have updated our curriculum as of May 6, 2024, and accordingly revised our e-booklet, final exam, and syllabus to reflect these changes.

Globally Certified KYC Specialist Certification Enrolment Procedure and Curriculum

Enrolment and Access Procedure:

- Payment and Course Access:

- Click on the add to cart option to pay the fees (listed fees covers everything including tax). Upon payment, candidates gain access to the course materials, two mock exam and 2 attempts for final exam.

- This membership includes the ability to download the study e-booklet that covers the full syllabus for end-to-end KYC along with mock exams and final exam.

- Study Materials:

- The e-booklet provided contains comprehensive information on all topics required for the Globally Certified KYC Specialist exam.

- Mock Exams:

- Students will receive access to a mock exam attempts to practice and prepare for the final exam.

- Final Exam Details:

- After studying and completing mock exam, students can attempt the final exam at any time (Lifetime access)

- The final exam consists of multiple-choice questions (MCQs) and can be taken online at any time convenient to the student.

- Once exam is passed, candidate will get certificate along with credential ID on an email.

- Scoring and Retakes:

- A passing score of 85% is required.

- There are no negative marks for incorrect answers. However, skipping questions will result in negative marks.

- Candidates will have two attempts for final exam, If all initial attempts are exhausted, each subsequent exam attempt will incur a fee of $19 USD.

- If you attempt more than two times, an additional fee must be paid for each subsequent attempt. Payment should be arranged by contacting support at support@globalaks.com via email.

- Become a partner if you have already enrolled for the certification and earn 10% for each successful referral

Globally Certified KYC Specialist Curriculum

- Introduction to Corporate KYC

- Fundamentals of Corporate KYC

- The importance and objectives of Corporate KYC in the financial industry

- Introduction to Anti-Money Laundering

- Basics of Anti-Money Laundering (AML)

- Stages of money laundering: Placement, Layering, Integration

- The KYC Process

- Customer Onboarding and Risk Assessment

- KYC Documentation Requirements for Individuals and Corporates

- Identity Verification of Individual Beneficial Owners

- Verification of Source of Funds and Wealth

- Ongoing KYC and Customer Due Diligence (CDD)

- Regulatory Frameworks by Region

- Key regulations and compliance standards in different jurisdictions, including the role of:

- Office of the Comptroller of the Currency (OCC)

- Financial Crimes Enforcement Network (FinCEN)

- Office of Foreign Assets Control (OFAC)

- Foreign Account Tax Compliance Act (FATCA)

- European Union AML Directives

- United Nations Sanctions

- USA PATRIOT Act

- Financial Action Task Force (FATF)

- The Wolfsberg Group

- The Basel Committee on Banking Supervision

- KYC for Different Corporate Structures and Entity Types

- Detailed understanding of KYC requirements for:

- KYC Attributes

- Comprehensive knowledge of all key attributes required in Corporate KYC.

- Introduction to Risk Assessment in KYC/AML

- Leveraging Technology and Automation in KYC

- Customer Identification Programs (CIP) Systems

- Sanctions Screening and Watchlist Management

- Enhancing Due Diligence with AI and ML

- Advancing KYC Data Management and Analytics

- The Future of Corporate KYC

- Embracing Real-Time Compliance

- Perpetual KYC: Beyond Onboarding

- Event-Driven KYC and Continuous Monitoring

- Advanced Money Laundering Methods

- Overview of Advanced Money Laundering Techniques

- Case Studies on Complex Money Laundering Schemes

- Innovative Approaches to Illicit Fund Laundering

- Trade-Based Money Laundering (TBML)

- Use of Virtual Currencies

- Real Estate Laundering

- Shell Companies and Trusts

- Layering Through Financial Markets

- Use of Gambling and Casinos

- Trade of High-Value Goods

- Insurance Products and Premium Laundering

- Complicit Professionals and Gatekeepers

- Leveraging New Payment Methods and Fintech

- Analysis of Financial Institutions

- In-depth Review of Banking and Financial Institutions in AML

- Risks and Challenges in Non-Bank Financial Sectors

- Role of Specialized Industries and Professions in Financial Crimes

- Suspicious Activities and Reporting

- Advanced Decision-Making in SARs Filing

- Innovations in SAR Investigations

- Practical Workshops on Suspicious Activity Monitoring and Reporting

- Understanding and Combating Terrorist Financing

- Analyzing the Relationship Between Terrorism Financing and Financial Crimes

- Advanced Detection Techniques for Disrupting Terrorist Networks

- Advanced Investigative Techniques

- Conducting and Managing Complex Financial Investigations

- Strategies for Collaboration with Law Enforcement and Regulatory Bodies

- Future of AML/KYC Technologies

- Exploring the Impact of Blockchain, Cryptocurrencies, and Fintech

- Anticipating and Mitigating Future AML/KYC Challenges

- Practical Compliance Strategies

- Designing and Implementing Robust AML/KYC Frameworks

- Leveraging Technology for Enhanced Monitoring and Compliance

- Case Studies and Real-World Examples of AML/KYC Implementation

- Glossary and Key Concepts

- Understanding of all terms and concepts listed in the glossary section, including but not limited to AML/CFT programs, Beneficial Owners, Cash-Intensive Business, Correspondent Banking, Customer Due Diligence (CDD), Enhanced Due Diligence (EDD), and Regulatory Agency.

You will have lifetime access to the materials, and we will continuously update them with new topics based on feedback from various investment banks to ensure you stay current with industry standards.

Course Features

- Lectures 2

- Quizzes 2

- Duration Lifetime access

- Skill level Expert

- Language English

- Students 15703

- Assessments Self

Curriculum

Curriculum

- 4 Sections

- 2 Lessons

- Lifetime

- Go-AKS KYC Certification : Study Material1

- Globally Certified KYC Specialist (Go-AKS) : Mock Exam1

- Globally Certified KYC Specialist (Go-AKS) : Final Assessment1

- Certification Access1

Reviews

FAQs

Requirements

- There are no prerequisites for this course.

- Desktop, Laptop or Mobile with Internet connection.

Target audiences

- Graduate students studying finance, business administration, or law who wants to pursue career in compliance

- KYC professionals seeking to enhance their knowledge of KYC principles and practices to improve their employability in the compliance industry.