Overview

Overview

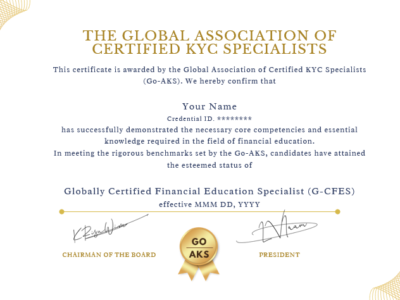

This certificate is bestowed by the Global Association of Certified KYC Specialist (Go-AKS) which is a globally recognized association, acknowledged in over 180 countries.

Enrollment and Access Procedure:

- Payment and Course Access:

- Upon payment, candidates gain access to the course materials.

- This includes the ability to download the study e-booklet that covers the full syllabus for G-FCCI.

- Study Materials:

- The e-booklet provided contains comprehensive information on all topics required for the G-FCCI exam.

- Final Exam Details:

- After studying, students can attempt the final exam at any time (Lifetime access)

- The final exam consists of multiple-choice questions (MCQs) and can be taken online at any time convenient to the student.

- Candidates have two attempts to pass the final exam.

- Scoring and Retakes:

- A passing score of 85% is required.

- There are no negative marks for incorrect answers.

- However, skipping questions will result in negative marks.

- If all two initial attempts are exhausted, each subsequent exam attempt will incur a fee of $19 USD.

Globally Certified FCC Investigator (G-FCCI) Certification Syllabus

Course Features

- Lectures 2

- Quizzes 2

- Duration Lifetime access

- Skill level All levels

- Language English

- Students 3444

- Assessments Self

Curriculum

Curriculum

- 4 Sections

- 2 Lessons

- Lifetime

Expand all sectionsCollapse all sections

- G-FCCI CERTIFICATION : STUDY MATERIAL1

- Globally Certified FCC Investigator (G-FCCI) : Mock Assessment1

- Globally Certified FCC Investigator (G-FCCI) : Final AssessmentImportance of the Final Exam The final exam is not just a test of knowledge but a benchmark for professional competence in the field of financial crime compliance. Achieving certification signifies that a candidate is fully equipped to contribute effectively in roles that require a high level of diligence, analytical skills, and ethical standards in the compliance industry. Successful candidates are recognized as having the expertise necessary to navigate and manage complex compliance scenarios, making them valuable assets to their organizations and the broader financial compliance community.1

- Certification Access1

Reviews

Reviews

Features

- Equip professionals with the necessary skills to effectively identify, investigate, and mitigate financial crimes.

- Foster a deep comprehension of risk management strategies tailored to the complexities of financial crimes.

- Prepare candidates to handle compliance violations with strategic insights into legal ramifications and public relations management.